Tips

How to use Funding Options' commercial loans calculator

7 Dec 2022

A commercial loans calculator can provide you with an estimation of how much your monthly loan repayments might cost. To calculate this you’ll need to input how much you want to borrow, the annual interest rate and term length. Let’s take a closer look at how commercial loans work and how much commercial finance your business could get.

What is a commercial loan?

In plain terms, a commercial loan – or a business loan – is a debt arrangement between a borrower and a finance provider, such as a bank or alternative finance lender.

Commercial loans can be used to fund operational costs such as rent payments or capital expenditures such as the purchase of equipment or machinery.

Common types of commercial loan include:

Asset finance – helps you fund a piece of equipment for your business.

Asset refinancing – lets you use your assets as security against a business loan.

Invoice finance – unlocks the cash tied up in your accounts receivables.

Commercial bridging loan – short term cash injection to fund a large expense.

Merchant cash advance – finance you repay through a percentage of your sales.

Revolving credit facility – a flexible alternative to business overdrafts.

Working capital finance – finance that gives you a working capital boost.

Commercial loans and collateral

Commercial loans are either secured or unsecured. A secured business loan requires you to provide a business asset, such as machinery, vehicles or property, as security against the finance. If you fail to repay the loan, the lender seizes the asset.

An unsecured business loan doesn’t require security, however the lender may ask you for a personal guarantee. This means you’ll be held personally liable for the debt if you don’t repay the loan. Creditworthiness can play a significant role in unsecured finance.

Commercial loans and creditworthiness

Business credit plays a role in almost every commercial loan type, as does cash flow. Healthy cash flows and a good credit rating helps assure the lender that you’ll be able to meet your commercial loan repayment terms.

The lender will probably carry out a credit check regardless of whether the loan you’re applying for is secured or unsecured.

However, unsecured loans usually have stricter standards when it comes to creditworthiness. The lender may check your personal credit report as well as your business credit report when making a decision.

Fortunately, it isn’t impossible to qualify for a loan if you have bad credit.

You might be eligible with a specialist lender if you’re willing to offer business assets as collateral, for example. You’ll also need a robust business plan to be able to show that your cash flow will remain healthy in the long-term.

How to use a commercial loans calculator

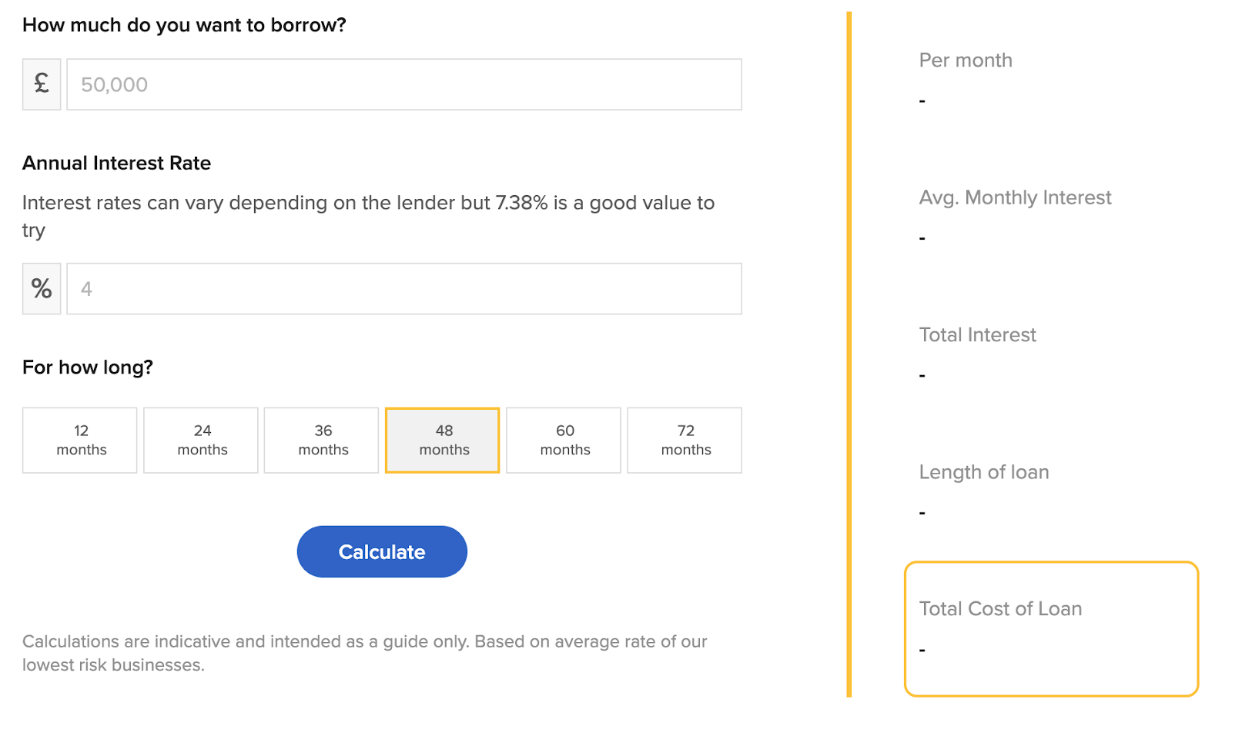

You can use a commercial loans calculator to work out how much your monthly loan repayments may cost and the overall cost of the loan.

You’ll need to input the amount you want to borrow (e.g. £5,000), the annual interest rate (e.g. 7.38%) and term length (e.g. 12 months) before you can hit ‘calculate’.

Here’s what Funding Options’ commercial loans calculator looks like:

What the Funding Options business loan calculator looks like.

Try our coOur commercial loans calculator is designed to provide business owners like you with an insight into how much you might be expected to repay, the average fixed rate monthly interest amount, the length of the loan and the potential total cost of the loan.

A commercial loan calculator is a useful tool that gives you an idea of how much your loan might cost based on hypothetical figures. The data that informs our calculator is based on the average rate offered to our lowest risk businesses. The rate you’ll pay will depend on your own business’ risk level, as well as the type of loan and lender.

Bear in mind that you may have to pay other fees and charges as well as the interest and loan amount, such as an arrangement fee or insurance.

Apply for a commercial loan

If you want to borrow between £1,000 and £15 million to help your business trade and grow with confidence, use Funding Options to see what you could be eligible for today.

Our fastest time from application to credit approval so far is 21 seconds. Based on the information you provide, such as loan amount and reason for finance, our technology will match you with instant, pre-approved offers from a variety of lenders.

You’ll also get expert support throughout the application process if you decide to go ahead with one of the finance options presented.

Start my funding journeyBusiness Finance

Check your eligibility using our online form without affecting your credit score.

Apply hereSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.