Education

Navigating through the macroeconomic landscape: an SME lending perspective

10 Jan 2023

Rising inflation is a growing concern for many business owners across the UK. Planning for business continuity, cash flow management and obtaining business funding are just some of the challenges business owners are facing in the current economic climate. In a recent webinar, our Senior Strategic Partnership Managers, Leon Jayasinghe and Ryan Ciecko hosted a live discussion about how the SME lending market is changing against the backdrop of the economic climate, and what SMEs and their advisors can do to navigate the challenges and improve their chances of securing funding.

If you don’t have time to watch the webinar in full, don’t worry. This article contains a recap of what Ryan and Leon discussed, including answers to some of the questions posed by our live audience. Before we dive into the detail, here are the top headlines:

Inflation is the most significant issue impacting the economy for UK SMEs

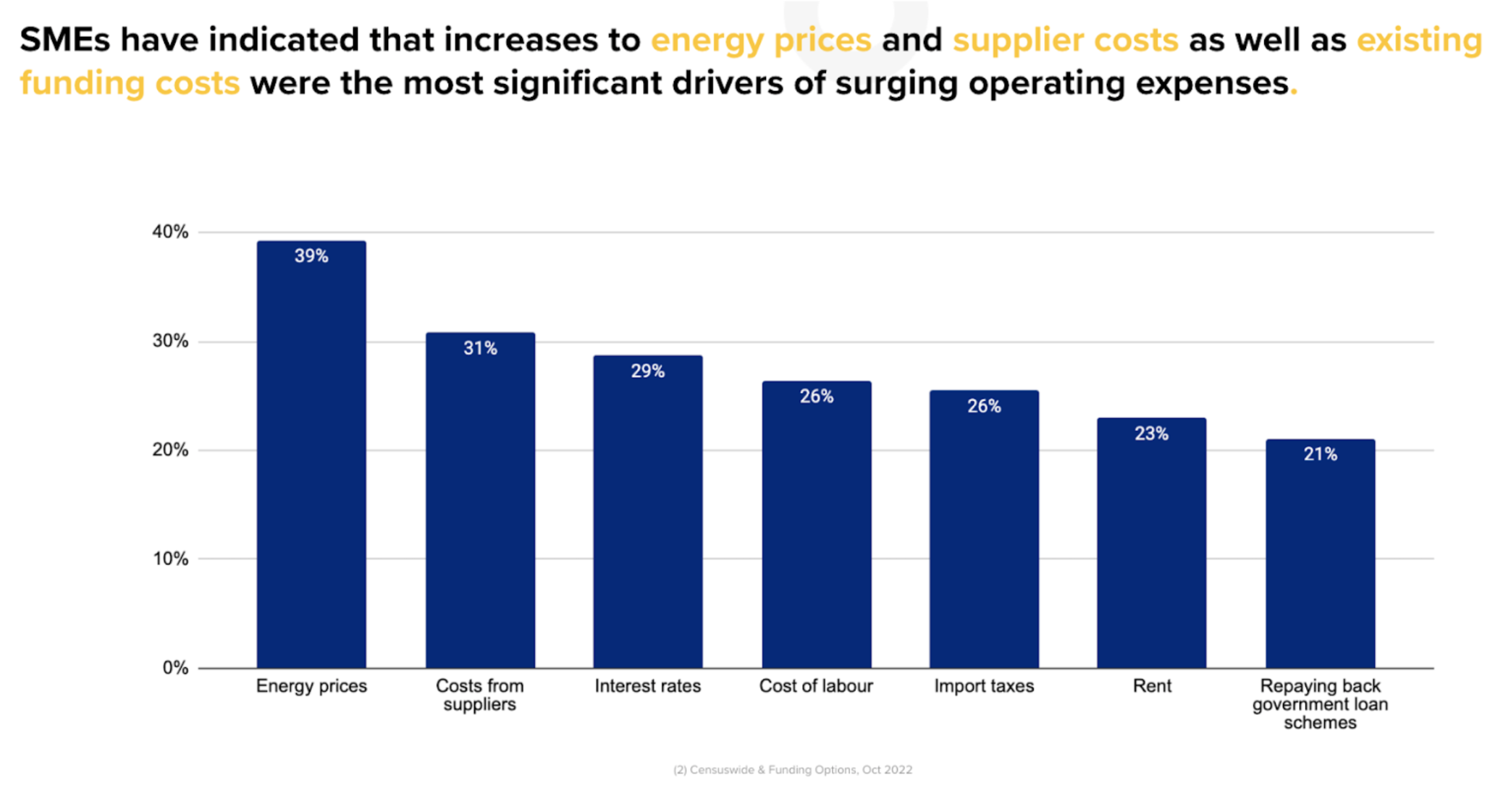

Energy prices is the largest driver of inflation in the economy and on operating costs for businesses

SME lending markets are directly impacted by inflation

Powerful and purposeful strategic decisions that incorporate supply chain resilience, new product/service development, pricing strategy and reducing operating costs will enable SMEs to win

It is still possible for SMEs to secure finance, even if they haven’t been trading for long or don’t own tangible assets

Which key drivers are impacting the UK economy?

Generationally high levels of inflation are having a huge impact on the UK economy, with the Consumer Price Index CPI soaring by 10.7% in the 12 months to November 2022.

As inflation rises, purchasing power decreases and interest rates increase.

Ultimately, this has an adverse impact on businesses, most of whom are looking for ways to curb spending and boost profitability. Soaring wholesale energy prices are compounding the issue. Businesses across all sectors of the economy are feeling the pinch, and asset prices and credit performance are under threat.

How is the SME lending market responding to current economic conditions?

Inflation is having an impact on both the lending products that are available in the market, and lenders’ level of risk aversion. Fewer businesses are able to meet affordability requirements and the required EBITDA threshold to qualify for a loan.

In times of economic turmoil, ‘[lenders] start to more heavily scrutinise the financials of a business; they’ll look at the balance sheet and scrutinise the level of solvency and liquidity, and how the current assets match to current liabilities…profitability becomes really important as well,’ explains Leon Jayasinghe in the webinar.

Inflation has an impact on loan term lengths too.

Lenders may also be less willing and able to extend credit for longer periods due to funding line restraints. Wholesale funding costs rise in line with the Bank of England base rate, 30-year gilt rates and SONIA rates. Ultimately, higher interest rates and shorter terms result in higher monthly repayments for businesses.

What steps can SMEs take to best position themselves in the current economic climate?

Despite the challenges today’s economy presents, there are some strategic decisions that businesses can make to improve their chances of weathering the recession.

For businesses looking to secure additional funding, balance sheet strength, credit health and revenue growth is key. In an unstable economic context, lenders tend to place greater onus on strong financials and business performance.

1. Supply chain resilience

Supply chains can be strengthened through negotiated bulk contracts, digitisation and switching to domestic supply sources. “When a business has the digital systems in place to analyse and make sense of big data, it leads to significant improvements in supply chain resiliency,” explains Ryan Ciecko.

For instance, a bicycle manufacturer might be able to access discounts on supply and shipping costs by bundling its parts, as opposed to buying them separately. A grocery retailer could boost sales through the use of data-enriched real time sales feeds that enable them to forecast and deliver demand plans direct to stores.

Meanwhile, a restaurant owner might decide to mitigate the risks associated with importing ingredients from abroad by finding a local supplier (a move that is also beneficial in that it has potential to drive down the business’ carbon footprint).

2. Low-cost, fast-developed products and services

Taking advantage of low-cost and quick-to-implement products or services can also help to bolster an SME’s resilience. For instance, identifying commercial and brand partnership opportunities can help a business expand its reach. For retailers, subscription services that include discount incentives could be worth exploring.

Businesses operating in the hospitality industry could look at bolt-on services to drive more revenue. A historic hotel, for example, may decide to host weddings at the venue and provide a wedding planning service at an additional cost.

3. Pricing strategy optimisation

There are various ways a small business can adapt its pricing to build a more robust business. One way is to tier its delivery prices by charging more for faster deliveries, and introduce free deliveries for orders that exceed a certain amount.

Another simple strategy is cancellation fees: for instance, a hairdresser could charge a cancellation fee for no-shows. A software developer could take a tiered approach to pricing, with the customer paying more to unlock additional features.

4. Operating cost management

It’s also important for businesses to take a strategic approach to their operational expenses as this can have a significant impact on profitability. Fixing energy tariffs, transitioning to sustainable energy generation and automating vital yet time-consuming administrative tasks could save businesses money.

Questions our SME audience asked us…

We also gave our live audience of SME owners the chance to ask questions.

Here’s what they wanted to know.

Q: What are the minimum turnover requirements that lenders require?

A: Some lenders will require a minimum turnover of £160,000 per annum. However, merchant cash advances will look at the business’ card terminal takings, while invoice finance looks at the outstanding invoices on the business’ balance sheet.

Q: Does not having tangible assets impact the likelihood of funding success?

A: As a general rule, it helps to have tangible assets such as property or other business assets. But in a modern economy most businesses simply don’t have tangible assets on their balance sheet; they might be working from home or be service based, for example.

Lenders will scrutinise cash flow, EBITDA and profitability levels, as well as the business’ growth trajectory and credit score. In other words, the need to have security against assets is much lower now than it used to be.

Q: What funding is available for startups?

Funding Options works with a number of innovative lenders that cater to early stage businesses. One is the British Business Bank Startup Loan company, which focuses solely on new start businesses. They offer up to £25,000 per director to either start a business or fund an existing one (as long as it’s been trading less than three years).

We also work with a number of e-commerce finance providers that focus on business' monthly recurring revenue and annual turnover. Unlike more standard term loans that require two to three years of trading, these require a minimum of six to nine months.

Startups looking for business finance will need to provide a cash flow forecast, a structured business model and information on the directors involved in the business.

Accounting software that ensures information is well maintained and accessible can also help set a startup up for success when it comes to securing funding.

Q: Is business funding available for non-homeowners?

There are more options available to homeowners, but we have many lenders on our panel that don’t require the business owner to be a homeowner. The more information the business is able to provide on the purpose of loan and profitability, the better.

Apply for business funding today

At Funding Options, we know how important it is for businesses to understand the economy, how it impacts the SME lending market, and what they can do to position themselves for success moving forward.

If you’re looking for business finance for your own company or your client, Funding Options can help. To get started, tell us how much funding you need, what you’ll be using it for and how quickly you need it. Advisory firms can use our Connect platform.

Get business fundingSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.